The nationwide lockdown due to the outbreak of COVID-19 has massively impacted majority sectors of India. The effect has also been witnessed in the credit disbursement procedure among the core sectors of the country.

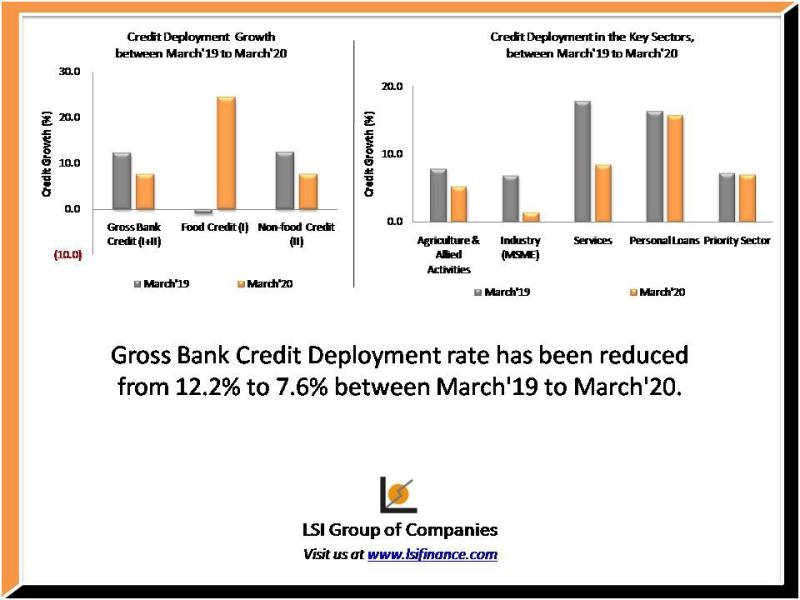

According to the data collected from the 39 Scheduled Commercial Banks (SCBs) regarding the deployment of bank credit, it can be seen that Gross Bank Credit Deployment rate has been reduced from 12.2% to 7.6% between March’19 to March’20.

The share of Non-food Credit deployment has been major in this deceleration which comprises of the sectors like Agriculture and allied activities, Industry (Micro, Small,Medium and Large), Services (eg. Transport operators, Shipping), Personal Loans (eg. Education) etc.